MomentumOptions.com Mid-Market Update for 4/19/2017

Imax (IMAX) on Deck With Earnings

1:50pm (EST)

Imax (IMAX) is scheduled to report earnings ahead of Thursday’s open with shares likely moving up or down 5%, depending on the news. While I have been mostly bullish on IMAX since shares were below $5 a decade ago, I think the company disappoints Wall Street this time around.

The company has topped estimates over the past four quarters by a penny twice, and four and seven cents while maintaining profitability. For the recently ended quarter, analysts are expecting Imax to earn $0.07 a share on revenue of $75.4 million.

The interesting part of this story has the company earning up to 22 cents while the low estimate has Imax losing 8 cents a share. This could mean a headline beat or miss of up to 15 cents and news that could move shares more than 5% and up to 10%.

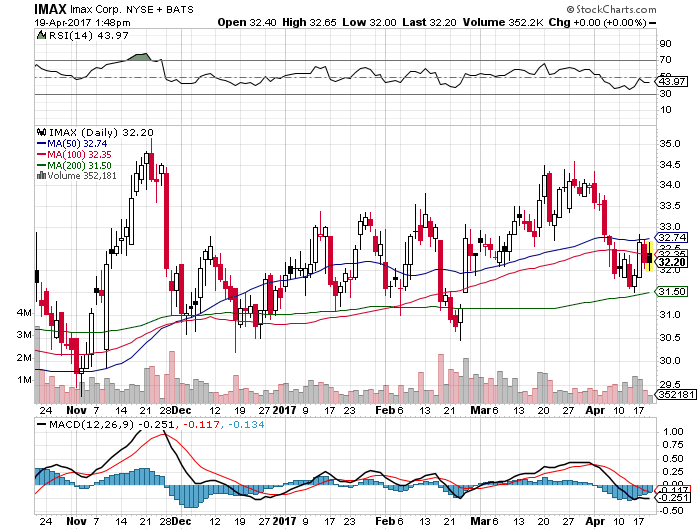

The chart shows near-term resistance at $32.50-$32.75 and the 50-day moving average. Support is at $32-$31.50 and the 200-day moving average. The directional move forthcoming could dramatically change the neutral setup over the next few months.

The IMAX May 34 calls (IMAX170519C00034000, $0.55, up $0.05) can be targeted by bullish traders expecting a possible earnings beat. These call options would double from current levels, technically, if IMAX shares trade past $35.10 by May 19th.

The IMAX May 30 puts (IMAX170519P00030000, $0.55, down $0.10) can be used by bearish traders expecting an earnings miss on a possible move below $30. These put options would double from current levels, technically, if IMAX shares fall below $28.60 by May 19th.

Together, both aforementioned options should create a strangle option trade for a premium of $1.10. If IMAX shares clear $36.20, or fall below $27.80 by May 19th, the strangle trade would double from current levels. If shares are at $35.10, or $28.90, by May 19th, the trade breaks even. Anything above or below these levels would be profitable.

Of course, the risk to all of these trades is that a directional trade goes against you, or, shares stay between $30-$34 by late May on the strangle.

It is hard to short a strong stock over the years and the company has some interesting new concepts coming to market. Smaller Imax theaters based on virtual reality could provide growth in the years to come but this market is just as crowded as box-office sales.

Their partnerships with China and other vendors around the world along with the development here at home are also impressive. The potential for Imax branded films and technology licensing deals could also add to the bottom line. However, I think this is a trap quarter despite decent movie sales this year.

As far as the market, IBM is keeping the blue-chips down but the other indexes are pushing higher highs. The Dow is down 69 points to 20,454 while the S&P 500 is gaining 2 points to 2,344. The Nasdaq is higher by 25 points to 5,875 and the Russell 2000 is adding 8 points to 1,370.

I’m working on another possible new trade I hope to have ready by the close, or by tomorrow morning. In the meantime, let’s go check on the current action.

Momentum Options Play List

Closed Momentum Options Trades for 2017: 22-9 (71%). All trades are dated and time stamped for verification. New subscribers can look at the past history to see how the trades have played out or to research our Track Records.

Do not risk more than 5% of your trading account on any one trade but do try to take all of the trades. Please remember, all “Exit Targets” and “Stop Targets” are targets. You should not have any “Hard Stops” entered to close any trades or “Exit Orders” in your brokerage account unless I list one. I will send out a “Profit Alert” or “New Trade” if I want you to close a position or if a new trade comes out. Otherwise, follow instructions at all times in the 8am and 12pm–2pm (EST) updates. Also, I will usually give you a heads-up if I think I’m going to send a Trade Alert outside of these time frames.

Viacom (VIAB, $44.47, up $0.38)

VIAB June 47.50 calls (VIAB170616C00047500, $0.75, up $0.10)

Entry Price: $0.55 (4/18/2017)

Exit Target: $1.10

Return: 36%

Stop Target: None

Action: Resistance is at $44.50-$44.75. Support is at $43.75-$43.50.

Best Buy (BBY, $49.88, up $1.35)

BBY May 45 puts (BBY170519P00045000, $0.30, down $0.15)

Entry Price: $0.57 (4/13/2017)

Exit Target: $1.15

Return: -47%

Stop Target: None

Action: Resistance at $50. Rising support is at $49-$48.75.

STMicroelectronics (STM, $14.61, up $0.03)

STM May 15 calls (STM170519C00015000, $0.60, flat)

Entry Price: $1.15 (3/31/2017)

Exit Target: $2.30

Return: -48%

Stop Target: 40 cents (Stop Limit)

Action: Resistance is at $14.75-$15 and the 50-day moving average. Support is at $14.50-$14.25.